Tax audit insurance without the icky bits

Protects your tax return from unexpected tax audit costs.

Transparent pricing, with no additional or hidden charges.

Advanced security measures to ensure the safety of your data.

Customizable coverage options tailored to meet your unique needs.

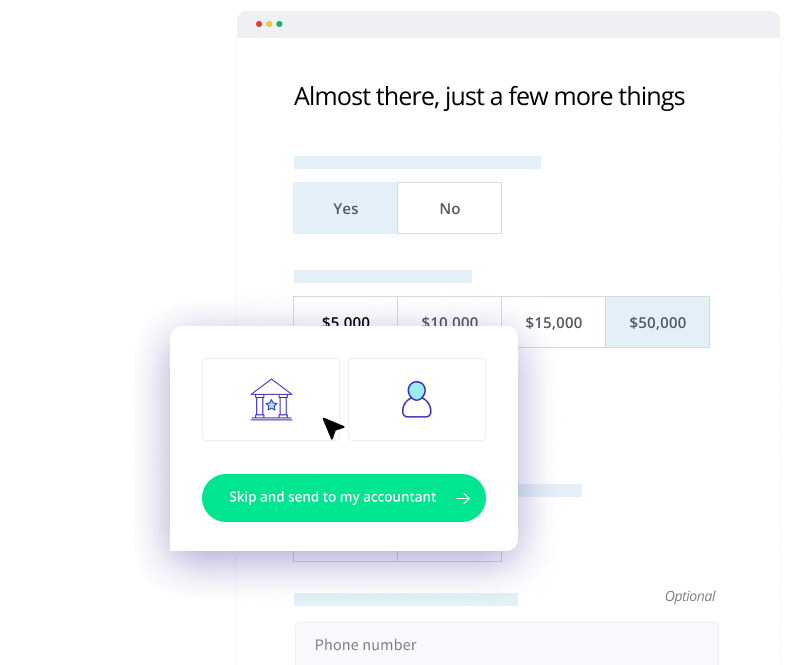

Smarter tax audit insurance will save you time, money and the hassle.

AuditCover insurance covers your accountants fees in responding to an audit, reducing stress and keeping more money in your pocket when you need it most.

Get a quoteJust some of the things we can protect you from...

WHAT OUR CLIENTS SAY

The AuditCover Team are Legends

The AuditCover team are legends. Easy to work with, incredibly responsive and helpful and solved a real pain point for All In Advisory with offering AuditCover to our clients. Their processes are so much more automated and seamless than other providers in this space. Breath of fresh air in fact! and so excited for where they can take this product.Aly Garrett,All In Advisory

AuditCover Are Awesome To Work With

The team at AuditCover are awesome to work with. Our previous experience with taking up audit insurance coverage for clients has been very manual but AuditCover made it really easy for us and our clients to set up and manage. The portal is user friendly and it's really clear and easy to understand. Highly recommend.Ahmad Beydoun,Fraser Scott & Co

AVS Advisors

It has been a pleasure working alongside AuditCover team. The whole process took next to no effort on our side and we were guided and supported throughout the process for whatever little we had to do. It has been a win-win for all.Vakel Dhillon,AVS Advisors

MJA Business Solutions

Our firm transitioned to AuditCover this year and the process has been seamless. They have taken care of all the administrative side of things, are available to assist with any queries in a timely manner. We’re no longer having to deal with client payments and the self-quote option for clients has brought a new level of ease for getting our clients the right cover for them. Our take up rates have increased as well which confirms to us moving to Audit Cover was the right choice not only for our firm but also our clients.Melanie Zander,MJA Business Solutions

The AuditCover Team are Legends

The AuditCover team are legends. Easy to work with, incredibly responsive and helpful and solved a real pain point for All In Advisory with offering AuditCover to our clients. Their processes are so much more automated and seamless than other providers in this space. Breath of fresh air in fact! and so excited for where they can take this product.Aly Garrett,All In Advisory

AuditCover Are Awesome To Work With

The team at AuditCover are awesome to work with. Our previous experience with taking up audit insurance coverage for clients has been very manual but AuditCover made it really easy for us and our clients to set up and manage. The portal is user friendly and it's really clear and easy to understand. Highly recommend.Ahmad Beydoun,Fraser Scott & Co

AVS Advisors

It has been a pleasure working alongside AuditCover team. The whole process took next to no effort on our side and we were guided and supported throughout the process for whatever little we had to do. It has been a win-win for all.Vakel Dhillon,AVS Advisors

MJA Business Solutions

Our firm transitioned to AuditCover this year and the process has been seamless. They have taken care of all the administrative side of things, are available to assist with any queries in a timely manner. We’re no longer having to deal with client payments and the self-quote option for clients has brought a new level of ease for getting our clients the right cover for them. Our take up rates have increased as well which confirms to us moving to Audit Cover was the right choice not only for our firm but also our clients.Melanie Zander,MJA Business Solutions

The AuditCover Team are Legends

The AuditCover team are legends. Easy to work with, incredibly responsive and helpful and solved a real pain point for All In Advisory with offering AuditCover to our clients. Their processes are so much more automated and seamless than other providers in this space. Breath of fresh air in fact! and so excited for where they can take this product.Aly Garrett,All In Advisory